Why Is Product Classification So Important?

Most importers know that duties applied to goods coming into the United States is determined by how a product is classified.

What they may not realize, however, is that the responsibility for properly classifying goods falls on the importer themselves. Customs penalties can arise for any number of reasons — failure to note the correct country of origin, inaccurate valuation of goods, or bringing in goods that are not invoiced or declared — to name a few. One of the most common risks comes from the improper classification of an item. Getting the classification right the first time avoids penalties and also helps to:

Avoid additional duties after the fact

Confidently and intelligently respond to Customs’ inquires

Potentially take advantage of certain import programs (such as Free Trade Agreements)

Learning how to properly classify goods can take years of study and experience. While it is always recommended to consult with a qualified Licensed Customs Broker, this overview will offer some base information on what you should know about classification codes.

What is the difference between HS and HTS Codes?

The act of “classifying” is a good means to identify the proper code within the Harmonized Tariff Schedule of the United States (HTSUS or HTS) which most accurately describes it. Understanding some of the background and rules of HTS, while also consulting with an expert in classification, will assist importers in demonstrating to Customs that they have taken reasonable care in the classification of their goods.

The HTS is based upon the Harmonized Commodity Description and Coding System (also known as the Harmonized System or HS) administered by the World Customs Organization. HS is described as “harmonized” because it is recognized in 98-percent of world trade. Most international Customs authorities apply this universal classification tool to import and export documentation and use it as the basis for their tariff systems.

For practical applications, an HTSUS code will range from six to ten digits in length. The first six digits are standardized and are identical to the HS Code for every country. The final four digits are for the US. A ten-digit HTS code is required when entering goods into the United States; the final digits vary by country.

It is a common practice for suppliers to provide a partial HTS code with their documentation. However, this is not a sufficient method of classification for accuracy and thoroughness because of the variance at the ten-digit level. To view the HTS list, visit https://hts.usitc.gov/.

The HTS code is designed to classify traded goods based upon their material composition, product name, and/or intended use. It helps ensure that each product is limited to only one category.

Example of HS/HTS Codes

Suppose you want to view the HTS code for scissors: 8213.00.3000, which includes the description “Scissors, tailors’ shears and similar shears, and blades and other base metal parts thereof: Valued not over $1.75/dozen” (as opposed to 8213.00.6000, Pinking shears, valued over $30/dozen).

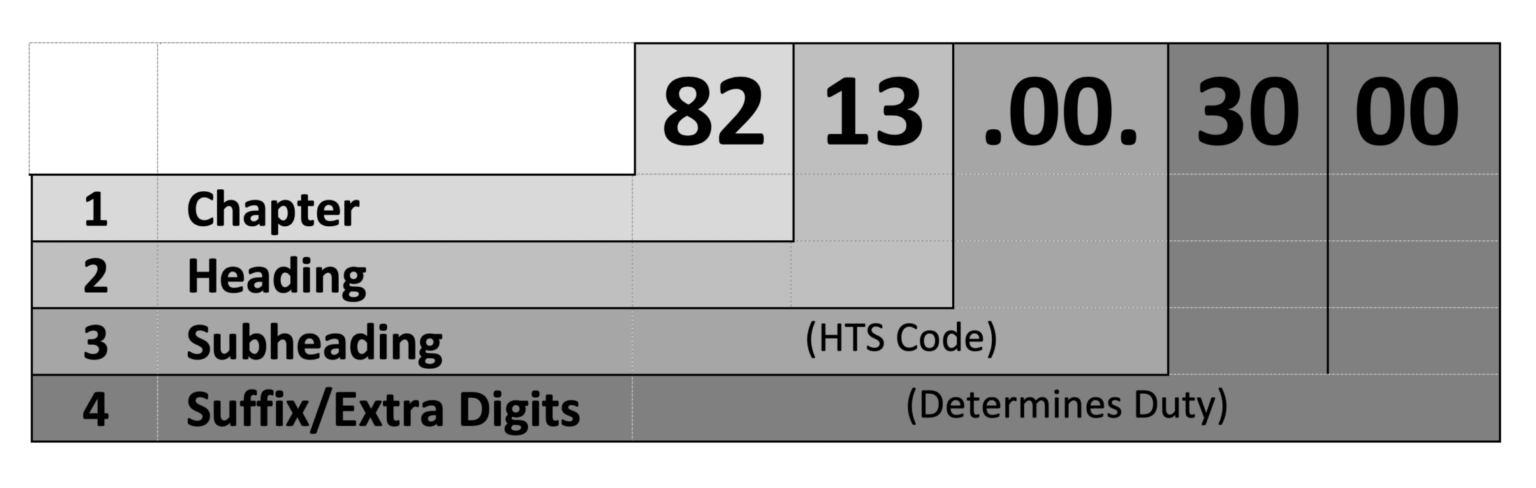

HS and HTS Codes have four parts, identified by the shaded number areas each component.

In this example:

Chapter: 82 refers to the HTS chapter.

Heading: 8213 – the next two digits identify the heading within the particular chapter.

Subheading: 8213.00 – the last two digits of a six-digit HS code are more specific and define the subheading of products.

Suffix (or Extra Digits): 8213.00.3000 – following the HS code, the subsequent two digits identify the US subheading to determine the duty rate, while the final two digits are a statistical suffix.

Here is the example as it appears on the ITC website:

As previously noted, HTS is based on a six-digit structure of the HS code set by the World Customs Organization (WCO). The additional four digits complete the HTS code and is set by the US International Trade Commission (ITC).

Conclusion

Even with a plain language introduction, the classification process is not always easy to grasp immediately. Customs brokers and trade lawyers spend years honing their classification abilities, yet US Customs places the responsibility and the liability for classification on importers. Misclassification of imported items could be seen as a lack of “reasonable care” or ruled a violation of 19 USC 1952 or the False Claims Act (FCA), which could subject guilty parties to:

Penalties for non-compliance

Seizure of goods

Border delays

Revocation of import privileges

And more…

Remember: All responsibility for properly classifying goods falls on the importer. Careful documentation of the classification process and consulting with a qualified expert, such as an experienced, Licensed Customs Broker, can help smooth out the import journey for all.

Other Resources

Explanatory Notes: These are published by the WCO and are the organization’s official interpretation of the Harmonized System. Explanatory Notes can be an extremely useful resource for guidance in the classification process, but they are not considered legally binding. Additionally, one must purchase a copy or have electronic access to the Explanatory Notes.

Customs Ruling Online Search System (CROSS): This is a free, online, searchable database of official US Customs classification rulings. Rulings are available to view dating back to 1989. This system is extremely useful in verifying whether a classification is correct. It can also provide a starting point when one is completely uncertain where to begin with an unusual article. While US Customs does change, modify, or revoke rulings from time to time, CROSS can be a wonderful source to cite as proof of the validity of certain classifications.

General Rules of Interpretation (GRIs): This is a set of rules that should be followed sequentially to determine proper classifications. To learn more about GRIs, read General Rules of Interpretation: How to Determine HTS Codes.

Schedule B: These ten digit codes are used by the United States to classify and catalogue exports from the US. Read U.S. Exports: A Guide to Classifying Products for an overview of Schedule B classifications and the use of the Automated Export System (AES).

To help guarantee a classification has been correctly assigned, importers always have the option to apply for a Binding Ruling from US Customs and Border Protection (CBP). A Licensed Customs Broker can assist you in presenting an argument for a favorable ruling. CBP will review and then assign classification (or valuation or country of origin). Keep in mind these determinations are binding and must be followed — though unfavorable decisions can be appealed.